- December 27, 2025

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Ripple IPO in 2026? Analysts Rank XRP Firm Among Top $50 Billion Public Listing Candidates appeared first on Coinpedia Fintech News

Ripple, the blockchain payments company behind XRP, is once again in the spotlight as reports suggest that it may be preparing for a possible initial public offering (IPO) in 2026.

Industry analysts now rank Ripple among the biggest potential public listings, with valuations estimated near $50 billion

Here’s what Ripple’s leadership is saying about these IPO talks.

Sign Shows Ripple Preparing for a 2026 IPO

According to multiple sources, Ripple is reportedly holding advanced internal discussions around a potential IPO in 2026. These are not rumors or casual considerations, but signs that the company may be actively preparing for a public listing.

The company has also strengthened its internal structure, with better reporting and governance, which are common steps before going public. At the same time, Ripple is expanding bank partnerships and payment services to build steady, real-world revenue.

Indeed, Ripple continues to position XRP as a liquidity tool within its payment system. IPO-ready companies usually highlight utility and long-term value rather than market hype.

Ripple Ranks Among Top IPO Candidates for 2026

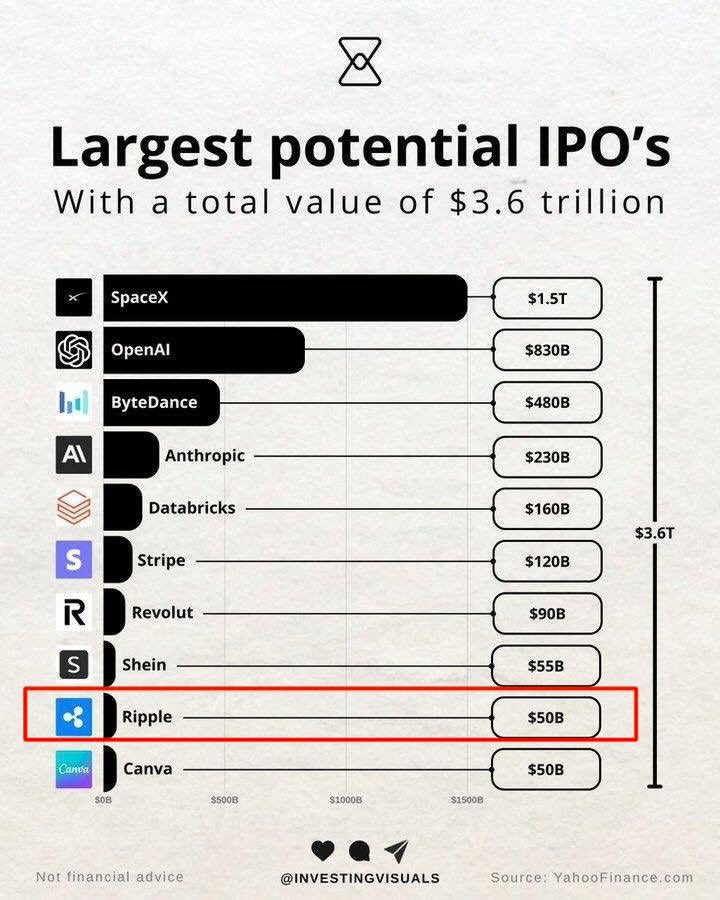

Adding to the excitement, market data and industry visuals now place Ripple among the largest potential IPOs heading into 2026. According to recent comparisons, Ripple ranks ninth among top private companies expected to go public, with an estimated valuation of $50 billion.

The list includes major global names such as SpaceX, OpenAI, ByteDance, and Stripe, highlighting just how significant Ripple’s position has become.

Analysts point to strong momentum, improving regulation, and growing global adoption as key reasons Ripple continues to stand out.

Ripple Leadership Pushes Back

Despite growing speculation, Ripple executives have consistently denied IPO rumors. Ripple President Monica Long has said the company has “no plan and no timeline” to go public, stressing that Ripple is well-funded and does not need public markets to raise capital.

Even Ripple CEO Brad Garlinghouse has echoed this view, noting that any IPO discussion would be a long-term consideration, not an immediate move.

Other Crypto Firms Move Closer to IPO

According to recent research reports, public markets are becoming the preferred next step for mature crypto firms. Circle has already gone public, and other major names such as Kraken, Grayscale, and BitGo have filed paperwork or entered advanced talks.

In Asia, Dunamu, the operator of Upbit, is also preparing a public debut through a merger. This broader trend has fueled speculation that Ripple could follow a similar path.