- December 27, 2025

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Ethereum Price at Critical Levels: Breakout or Breakdown Next? appeared first on Coinpedia Fintech News

Ethereum (ETH) is trading near a crucial price zone, leaving traders cautious as the market looks for its next direction. After weeks of volatile moves, ETH has entered a slower phase, hovering close to a key support area. The current price action suggests the market is at a decision point, where a strong move in either direction could soon follow.

Ethereum Price Analysis

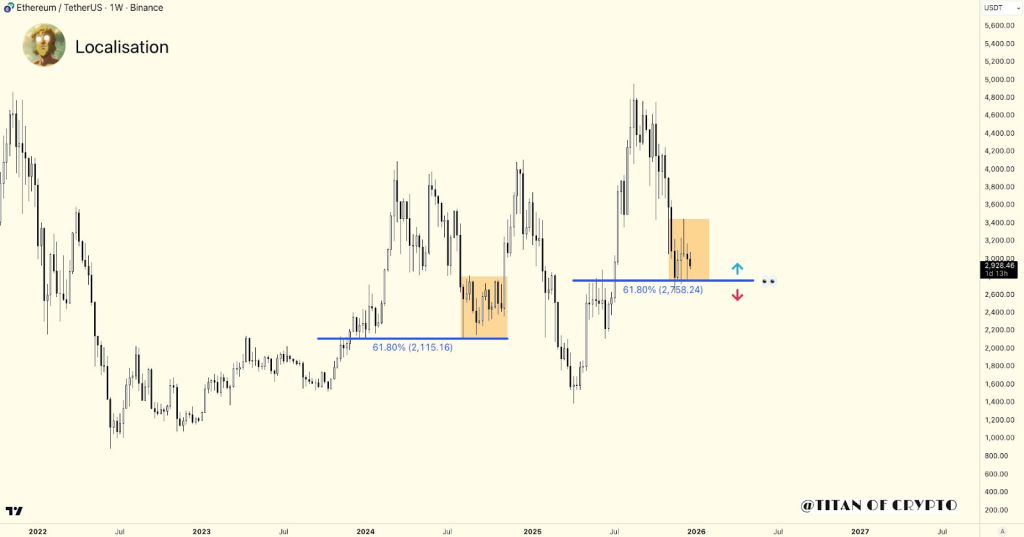

Looking at the chart, some traders believe Ethereum may be forming a Head & Shoulders structure. ETH moved into the $3,200–$3,250 range in early December, which could mark the left shoulder. This was followed by a stronger rally above $3,400, forming the head. The most recent rebound stalled lower, around $3,100–$3,150, which may represent the right shoulder.

The key support zone, often referred to as the neckline, sits between $2,900 and $2,950, where ETH is currently trading. While the structure resembles a classic reversal setup, it remains unconfirmed. Ethereum has not yet broken decisively below $2,900. Analysts say a clear 4-hour or daily close below this level, followed by continued selling, would be needed to confirm a downside shift.

Until then, Ethereum remains range-bound, with traders watching closely for a decisive breakout or breakdown.

ETH Price Bearish Case

One reason the bearish view remains weak is how the price is behaving near the right shoulder. Instead of facing a strong rejection, Ethereum has been moving sideways, forming a tight range. This kind of price action often leads to further consolidation or even continuation, rather than a sharp breakdown.

Momentum indicators also do not strongly support a downside move. The Relative Strength Index (RSI) is sitting between 45 and 50, showing neutral momentum. In clear Head & Shoulders reversals, RSI usually struggles near 60 on the right shoulder and then drops sharply. That pattern is not visible here.

Because of this, many traders see the current structure as a range or distribution phase, rather than a confirmed reversal. In stronger market cycles, similar setups often fail and turn into sideways movement before the broader uptrend resumes.

Key Levels: $2,900 Support and $2,750 Risk Zone

Ethereum has already retraced nearly 61.8% of its last impulsive move, a level where price reactions are common. While $2,900 remains immediate support, a deeper move toward $2,750 is increasingly viewed as the key downside level to monitor in the coming weeks.

If ETH fails to hold this zone, it could signal another liquidity sweep lower before any meaningful recovery.

Volatility Expected as Structure Tightens

Several analysts are warning that volatility could pick up soon. Ethereum often dips below visible support or “liquidity” levels to trigger sell orders before making a larger move. With Bitcoin also approaching a key turning point, ETH could briefly move lower and test recent lows before deciding on its next direction.

From a broader view, Ethereum has been stuck in a sideways correction since November 21, trading below the top of its corrective channel. A break above this channel would be the first sign that upside momentum is returning.

For a stronger bullish outlook, ETH would need to reclaim $3,550. Until that happens, the risk of continued consolidation or another short-term dip remains high.

- Also Read :

- Bitcoin Outlook 2026: Institutions Could Drive BTC Price to $170K, Says Michael Saylor

- ,

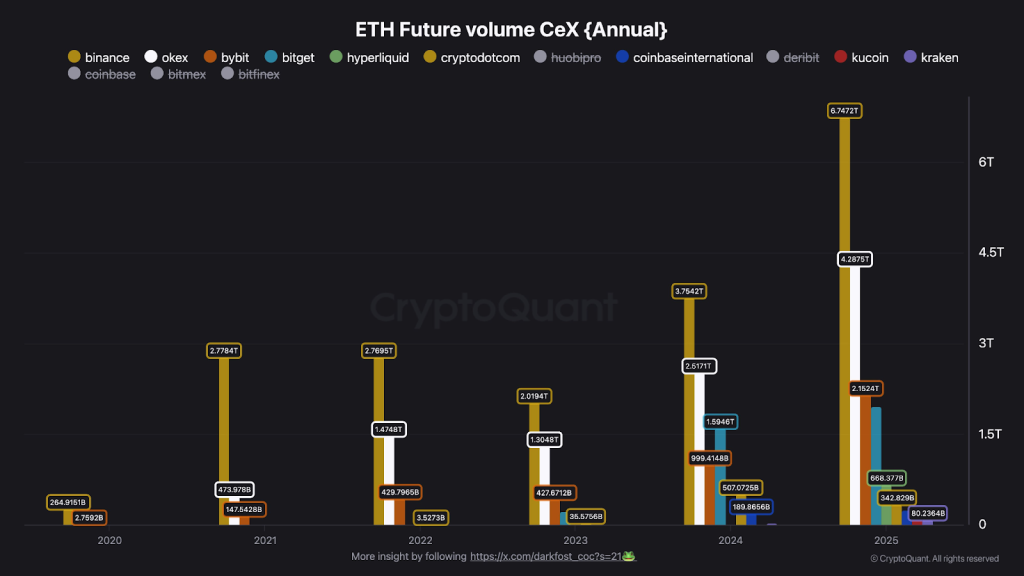

Ethereum Futures Trading Hits Record Levels

Despite uneven price performance in 2025, Ethereum has set a new record in derivatives trading activity. According to CryptoQuant data, for every $1 invested in ETH on the spot market, nearly $5 has moved into futures, showing how heavily traders are using leverage.

Binance alone saw over $6.74 trillion in ETH futures trading this year, nearly double the volume recorded in 2024. The same trend is visible across other major exchanges, including OKX, Bybit, and Bitget, all of which reported record highs in Ethereum futures activity.

This growing dependence on derivatives has made Ethereum’s price more volatile and less stable. Even with massive trading volumes, ETH only posted a small new all-time high, suggesting recent price moves have been driven more by liquidations than strong spot buying.

Ethereum Long-Term Outlook Remains Constructive

Despite the short-term uncertainty, the long-term outlook for Ethereum remains positive. Fundstrat’s Tom Lee recently said ETH could rise to $7,000–$9,000 by early next year, driven by Wall Street’s growing interest in tokenizing real-world assets on the Ethereum network.

Large institutions such as BlackRock and JPMorgan have already launched on-chain pilots, pushing real-world asset value locked on Ethereum past $20 billion. This strengthens Ethereum’s position as the main platform for on-chain settlements.

For now, Ethereum is at a key turning point. Traders are closely watching the $2,900 level, as the next clear move above or below this zone could shape price action in the weeks ahead.

FAQs

Ethereum could trade between $4,700 and $14,100 in 2026, depending on market cycles, network upgrades, and institutional demand.

Long-term models suggest ETH could exceed $15,000 by 2030 if network upgrades, institutional use, and market growth continue steadily.

Ethereum’s long-term outlook is supported by network upgrades, institutional adoption, and Layer-2 growth, but it still carries market and regulatory risks.

Key risks include regulatory uncertainty, macroeconomic changes, centralization concerns in staking, and shifts in overall crypto market sentiment.