- February 20, 2026

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post MYX Finance Price Prediction 2026, 2027-2030: Is MYX the Next Big Decentralized Futures Play? appeared first on Coinpedia Fintech News

Story Highlights

- The Live Price Of MYX Is $ 1.35784090

- With innovation in cross-chain derivatives and rising on-chain activity, MYX could reach $30 by 2026 and up to $50 by 2030 if similar momentum continues.

- MYX surged over 20,000% from June lows to September highs, making it one of the year’s best performers.

MYX Finance is positioning itself as a next-generation decentralized perpetual futures exchange, targeting traders who want on-chain transparency without sacrificing leverage and execution speed.

As centralized exchanges face increasing regulatory pressure, perpetual DEXs like MYX are attracting users looking for non-custodial alternatives.

While the overall cryptocurrency market is under pressure, MYX Finance’s native token (MYX) is moving in the opposite direction. The token jumped around 15% in the last 24 hours, trading near $3.5, even as Bitcoin, Ethereum, and most altcoins slipped lower.

At a time when overall market sentiment remains weak, MYX’s strong price action has turned heads. Making investors curious about the token growth, wondering what the future will be for these tokens.

With that in mind, let’s take a closer look at our MYX Finance (MYX) price outlook for 2026 to 2030.

MYX Finance Price Today

| Cryptocurrency | MYX Finance |

| Token | MYX |

| Price | $1.3578 |

| Market Cap | $ 341,460,899.12 |

| 24h Volume | $ 113,797,220.9708 |

| Circulating Supply | 251,473,423.70 |

| Total Supply | 1,000,000,000.00 |

| All-Time High | $ 19.0135 on 11 September 2025 |

| All-Time Low | $ 0.0467 on 19 June 2025 |

Table of contents

Coinpedia’s MYX Price Prediction 2026

MYX price saw bullish momentum with a rise to $7.56 in January 2025, but February’s decline broke key support levels, flushing out weak investors. The project remains solid due to its strong exchange use case, although its token is prone to manipulation. Early investors are still committed, and we may see consolidation in Q1 2026, but another decline could challenge the bullish outlook.

What is MYX Finance?

MYX Finance is known as a decentralized futures exchange designed to make derivatives trading more accessible, efficient, and user-friendly to the people who want’s to trade.

Unlike other traditional platforms, MYX incorporates a uniquely brought Chain-Abstracted Wallet that allows traders to move seamlessly across blockchains without manual bridging.

Its simplicity has an innovative two-layer account model that ensures users maintain custody of funds while enabling gasless transactions through a relayer network.

The another highlights that makes MYX more attractive is that this exchange supports leverage of up to 50x with zero slippage, powered by its matching pool mechanism. This enhances efficiency and reduces trading risks.

MYX Finance (MYX) Price Prediction 2026

The consolidation in Q4 2025, followed by a remarkable surge to $7.56 in January, underscores the strong bullish momentum we observed in MYX.

But in February, it declined much faster, and it didn’t stop at the multi-month ascending trendlines’ dynamic support; it even dipped below the $1.0 support of September 2025.

What this implies is the flushing of weak hands and repositioning of strong hands at much discounted prices. The project is not a dead chain; it has a strong use case: it’s an exchange with many users trading different asset pairs, so, utility-wise, it doesn’t have any issues. But its token is seen as very prone to manipulation by big players.

The late joiners in this asset have been flushed out, but early investors who haven’t given up on it are still on board and reluctant to square off yet.

Since the liquidity grab happened in Q1, we can now expect a consolidating range in the rest of Q1 2026, which will confirm buying. But if it sees a similar momentum following another decline, the bullish theory can be invalidated.

Fundamental Growth and Ecosystem Strength Stay Unaffected

With the October crash, many are thinking MYX is done for, but it’s the exact opposite because the price action might not be supporting now due to macro factors, but fundamentals have never been better.

As MYX Finance’s explosive growth is firmly rooted in robust on-chain fundamentals, moving beyond mere speculation. The platform has demonstrated consistent and significant expansion in user activity, evidenced by its surging monthly trading volume. This volume more than doubled during the year, climbing from $51 billion in January 2025 to $128.43 billion by late December.

Also, Earnings have more than doubled in the same period, jumping from $18 million to $57.45 million.

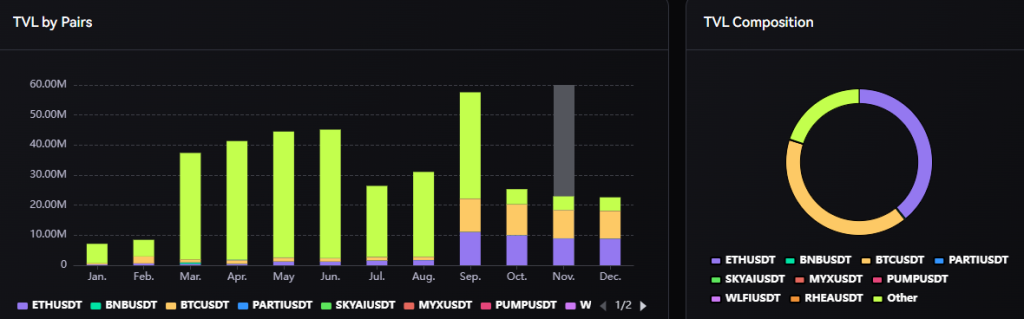

Apart from this, the TVL has taken a strong hit to a previous explosive growth to nearly $58 million by September, but by December, it has crashed down to $22.60 million.

If this momentum continues, MYX Finance could shed more TVL. However, if its adoption increases with MYX showing any price catalyst, its TVL could regain its lost levels once again in 2026.

MYX Finance Price Prediction 2026 – 2030

| Year | Minimum Price | Average Price | Maximum Price |

| 2026 | $10.50 | $18.00 | $30.00 |

| 2027 | $12.00 | $24.50 | $37.00 |

| 2028 | $15.50 | $29.00 | $42.00 |

| 2029 | $19.00 | $35.00 | $46.00 |

| 2030 | $21.00 | $38.00 | $50.00 |

What Does The Market Say?

| Year | 2026 | 2027 | 2030 |

| CoinCodex | $9.50 | $14.99 | $40.87 |

| Pricepredictions | $6.3 | $11.8 | $28.09 |

| DigitalCoinPrice | $7.41 | $18.71 | $37.75 |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

MYX Finance is a decentralized perpetual futures exchange offering up to 50x leverage, gasless trades, and non-custodial accounts across blockchains.

MYX’s long-term potential depends on trader adoption, platform reliability, and growth of decentralized derivatives markets through 2026–2030.

For 2026, MYX is projected to trade between $2.8 and $10.44, depending on user growth, market conditions, and protocol performance.

If MYX becomes a major on-chain derivatives platform with strong liquidity and revenue, long-term forecasts suggest prices near $40–$48 by 2030.